Convenient Method to Transfer Funds

Today, EUROPEAN CROSS BORDER PAYMENTS are made easier for the events to send, as a result of the use of IBAN which means International Bank Consideration Number for short.

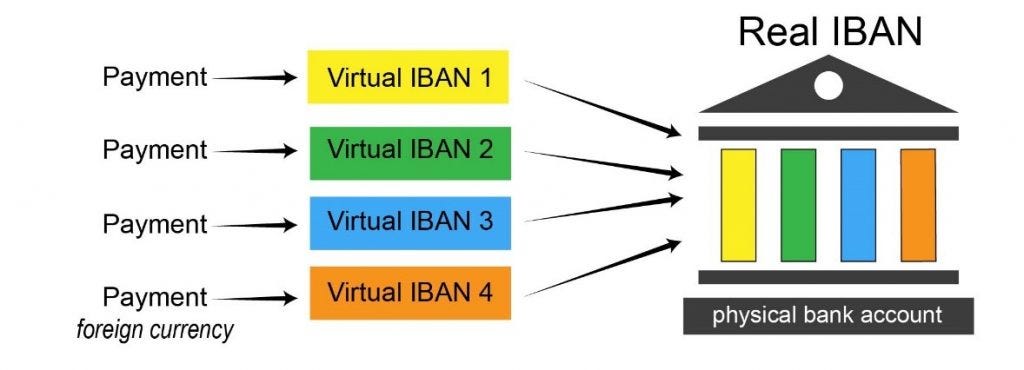

IBAN is really a bank signal which recognizes the consideration number and additional characters, ergo preventing possible mistakes. It must be noted nevertheless, that their validation isn’t any guarantee that the account number or bank signal is appropriate or that it exists. It is the duty of the account owner to tell their IBAN to the party they need to offer with.

The IBAN is given for the account by the bank providing that account, and should just be taken from that bank. It prevents finding probable wrong virtual iban providers details, as this may cause delay in getting payment. No body wants any setbacks when coming up with international currency exchange payments. Businesses working with global income transfers are very correct and are eager to improve one currency against another as rapidly while they possibly can, to perform the deal and show their clients how efficiently and easily they perform.

The financial institution recognition signal BIC is still another abbreviation, that you simply should come across. BIC is just a means of to be able to identify financial institutions so your means of telecommunication in financial institutions/banks is facilitated. In order to make a payment, it is required to offer the IBAN and BIC. The usage of IBAN became compulsory since September 2003. Many folks have heard about the abbreviation SWIFT, which represents Culture for World wide Interbank Financial Telecommunication

SWIFT is a worldwide service of protected economic message service. It’s this support that international currency trade companies use to maneuver the cash bank to bank. It is also the exact same service constantly used to maneuver countless kilos and different currencies by countless other economic institutions. It’s quickly and safe. When coming up with international currency moves you will simply need certainly to complete a questionnaire, which the company you choose to accomplish the business with will provide. The several previously discussed details, offer only to see these, who hope to learn what certain abbreviations really stand for, plus a small reason here and there.

The term money transfer company identifies the capacity to move money from anyone (or institution) to another. The fastest and safest approach to moving resources is via bank cable transfers, the process for such a move is the following: The person who wishes to implement the transfer suggests their bank of the quantity of income to be paid along with the bank details of the payee; these facts will include the IBAN and BIC code.

Once the giving bank has obtained most of the appropriate details and authorization they will transfer a message, with a protected process, to the receiver’s bank so it effect payment as per the instructions given. This sort of move typically takes three organization times for the resources to clear. The price tag on a bank wire move will be different based on such facets as the country the money has been delivered to, the total amount the cost is for etc.

The majority of global transfers are refined via a co-operative culture named SWIFT, which operates an international system to facilitate the transfer of economic messages. Banks use these financial messages to change knowledge for the move of funds between the many economic institutions. Each financial institution is assigned a signal, often called a Bank Identifier Signal (BIC) or Fast Code.